Sarkar ke niyamo ke anusar kisi bhi business mein ab GST file karna anivarya hai. GST ek aisa tax hai jo ki kaafi zyaada news mein hai aur Indian economy ke liye yeh ek bahut hi bada kadam hai. Issi kaaran ki wajah se logon ke dimaag mein bahut utsukta hai yeh janane ke liye ki GST Registration Process In Hindi kya hai, aur iss article mein hum aapko GST Registration Kaise Kare ki puri jankari denge.

Iss article mein aap janenge ki

GST Registration kisko karwana chaiye

GST Registration Kaise Kare Online

GST Hota Kya Hai

GST ka full form hai ‘Goods and Services Tax‘. 1 July 2017 ko GST Act humare desh mein laagu kiya gaya tha, jiske zariye baaki ke saare taxes hata diye gaye the ( VAT, Service Tax etc) aur ab sirf yahi ek tax laagu hota hai.Yeh tax Finance Ministry ke under aata hai aur iss tax ke liye specially ek GST Council banaya gaya hai jo ki GST se judi saari decisions leta hai. Iss tax ke abhi teen rates hain- 5%,12%,18% aur 28%, aur yeh government decide karti hai public ko kaunse product ke liye kitne tax ka bhugtaan karna hoga.

GST Number Kya Hota Hai

GST number ek aisa number hota hai jo ki aapke business ke liye unique hota hai aur GST registration process ko khatam karne ke baad hi aapko yeh number milta hai. Kisi bhi receipt pe aapka GST number visible hota hai aur aapke GST number ke through easily aapke business ke saare details ke baare mein pata chal sakta hai.

GST Registration Kisko karwana chahiye

GST registration kaise kare se pehle hum janenge ki GST registration kin logon ke liye karwana compulsory hai. Yeh unn sabhi logon/ businesses ke liye compulsory hai jo ki GST se pehle waale Tax rules ke under enrolled the, jaise ki VAT,Excise etc. Yeh registration unn businesses ko bhi karwana padega jinka turnover Rs. 40 Lakhs se zyaada hai, aur North-Eastern States, J&K, Himachal Pradesh aur Uttarakhand ke liye yeh amount Rs. 10 Lakhs se upar hai. Yeh E-commerce businesses, Suppliers, Distributors ke liye bhi karwana zaruri hai.

GST Number Ke Liye Documents

Business ke owner ko apne GST Registration Form ke saath kuch documents bhi submit karna compulsory hai, jaise ki-

PAN of the Applicant – Government dwara issued PAN Card aapko submit karna hoga apne form ke saath. PAN Card ek bahut hi zaruri document hai,aur agar aapka PAN Card nahi bana hua hai toh PAN Card ke liye apply karne ke liye yahan click karein.

Aadhaar Card – Aaj ke time mein Aadhaar Card ek bahut hi zaruri document bangaya hai aur har sarkari kaam ya application ke liye Aadhaar Card ki zarurat padti hai, chahe woh college admission ho ya kisi business ka GST Registration. Agar aapka Aadhaar card bana hua nahi hai toh Aadhar card ka application process janane ke liye yahan click karein.

Proof of business registration or Incorporation certificate – Aapko apne GST Application form ke saath apne business ka incorporation certificate aur business ke registration ka proof bhi saath mein attach karna padega.

Identity and Address proof of Promoters/Director with Photographs– Aapko apne ID proof aur address proof ke liye documents submit karne honge, jaise ki Drivers License, Voter ID Card ya Bank Passbook.

Address proof of the place of business – Apne Business ke address ko register karwane ke liye aapko apne business ka address proof bhi GST registration form ke saath submit karna padega.

Bank Account statement/Cancelled cheque – Aapko apna ek cancelled cheque ya fir apna Bank Statement bhi submit karna hoga.

Digital Signature – Digital Signature aapka normal signature hota hai bas yeh farak hai ki yeh digital form mein hota hai.

Letter of Authorization/Board Resolution for Authorized Signatory

Proof of Constitution of Business (Any One) | Certificate of Incorporation |

Photo of Stakeholder (Promoter / Partner) | Photo of the Promoter/ Partner |

Photo of the Authorised Signatory | Photo |

Proof of Appointment of Authorised Signatory (Any One) | Letter of Authorisation Copy of Resolution passed by BoD/ Managing Committee and Acceptance letter |

Proof of Principal Place of business (Any One) | Electricity Bill Legal ownership document Municipal Khata Copy Property Tax Receipt |

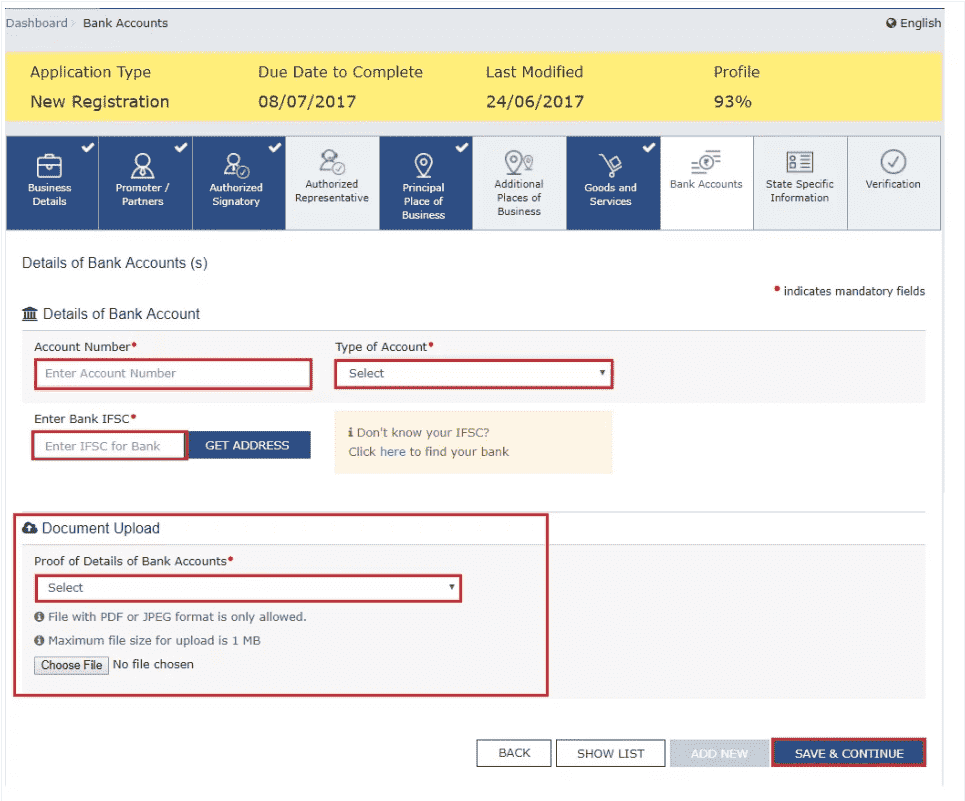

Proof of Details of Bank Accounts (Any One) | First page of Pass Book Bank Statement Cancelled Cheque |

GST Registration Kaise Kare Online

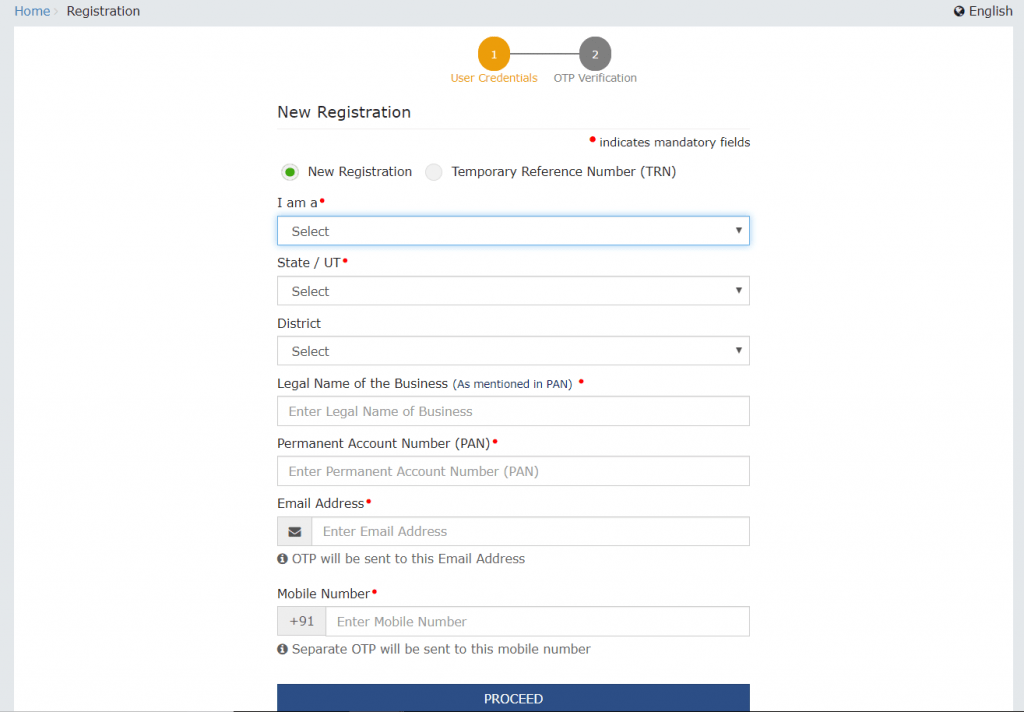

Step 1. GST Portal pe Jaayein

- GST Portal pe jaane ke liye apne browser mein gst.gov.in type karein.

- Uske baad iss order mein buttons ko click karein- Services > Registration > New Registration

Step 2. Temporary Reference Number (TRN) Generation

- Ab jo screen khulega uspe aapko apne saare details fill up karne hain jaise ki apna naam, address, PAN Card details, mobile number etc.

- Yeh sab details fill karne ke baad “Proceed” pe click kijiye.

- Iske baad OTP Verification waala screen aayega, jismein aapko do alag alag OTP daalne honge- Mobile OTP aur Email OTP, jo ki respectively aapke mobile aur email pe aapko aaye honge.

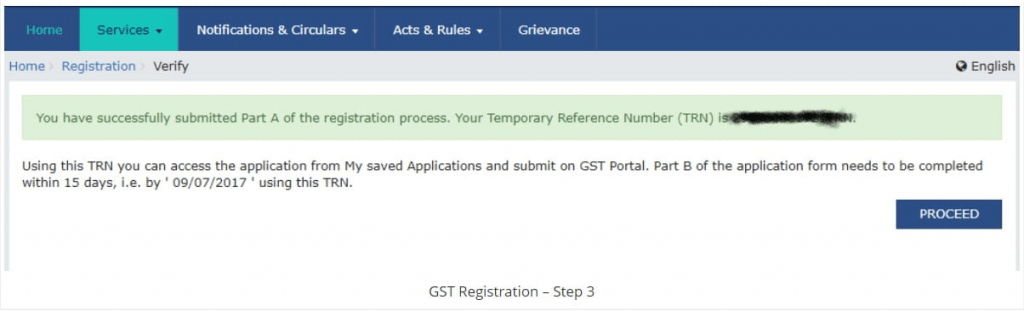

OTP sirf 10 minutes ke liye valid rahega toh aapko yeh sabkuch jaldi aur dhyaan se fill karna hoga. - Iske baad aapke paas TRN Generated waala screen aajayega. Yahi TRN ab poore GST application ko poora karne mein use hoga.

Step 3. TRN ke saath login

- GST portal pe ab aap jaake apna TRN enter karein aur saath mein captcha enter karein.

- Iske baad aap apne mobile aur email OTP verification ka process poora karein jiske baad aap highlighted button ko press karenge jo ki aapko GST Registration page pe lejaayega.

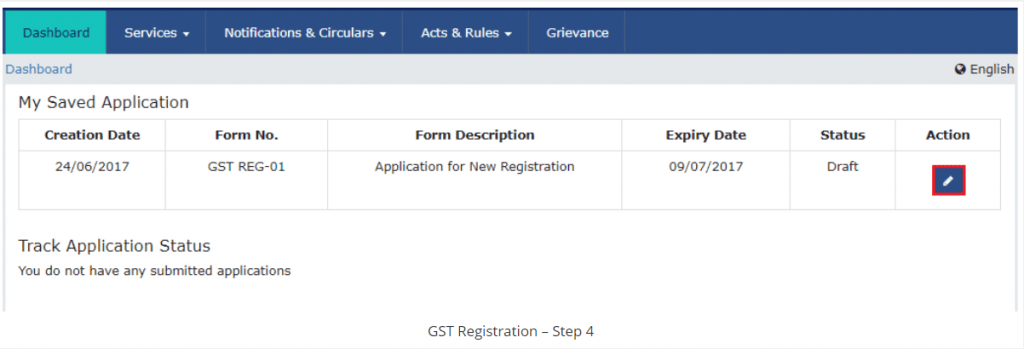

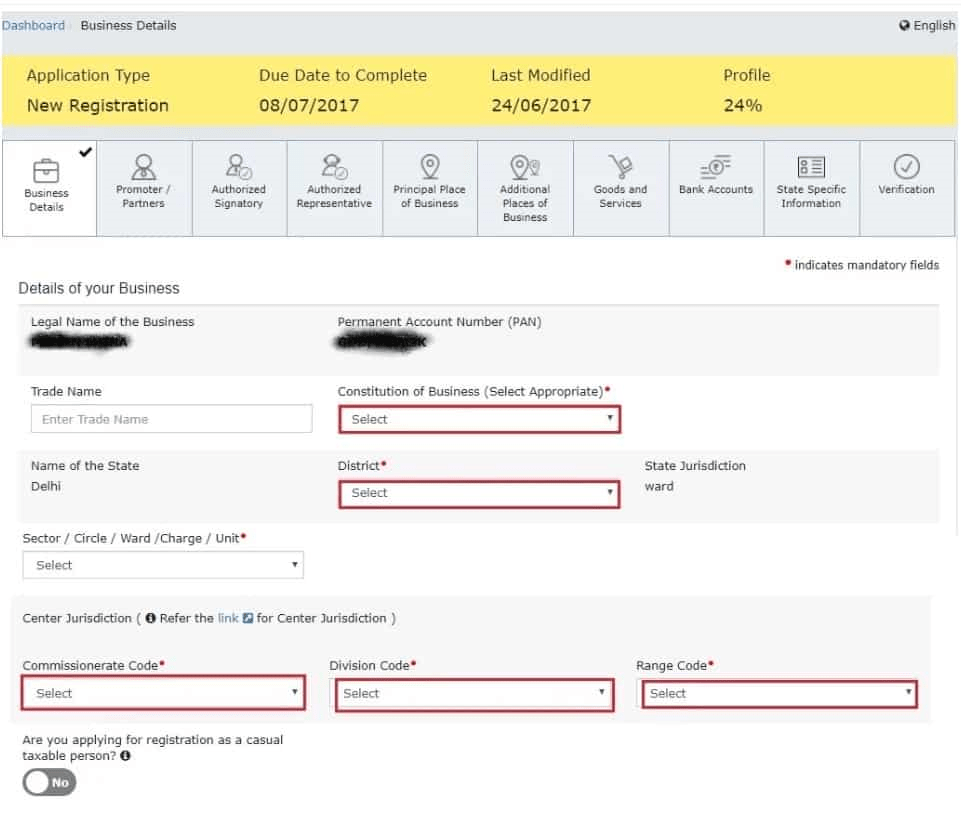

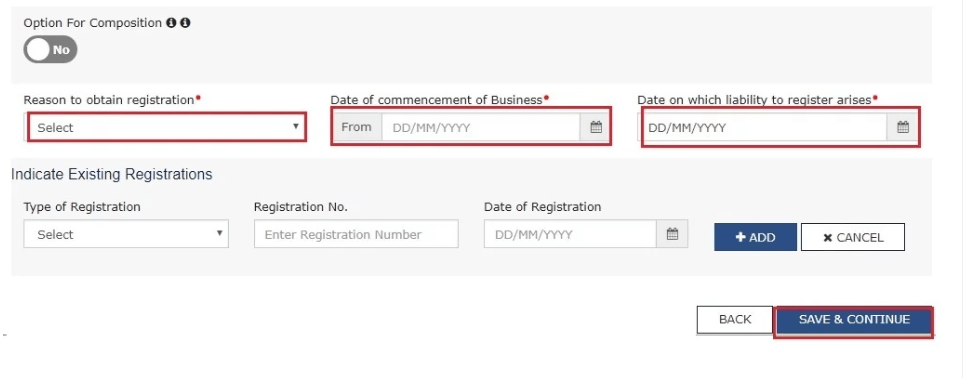

Step 4. Business Details ka Submission

- Iske baad jo window khulega usmein aapko apne business ke baare mein saari details daalni padengi jaise ki business ka naam,address, business shuru karne ka din etc.

- Yeh sab fill up karne ke baad “Save & Continue” pe click karein ko ki aapko agle step pe le jaayega.

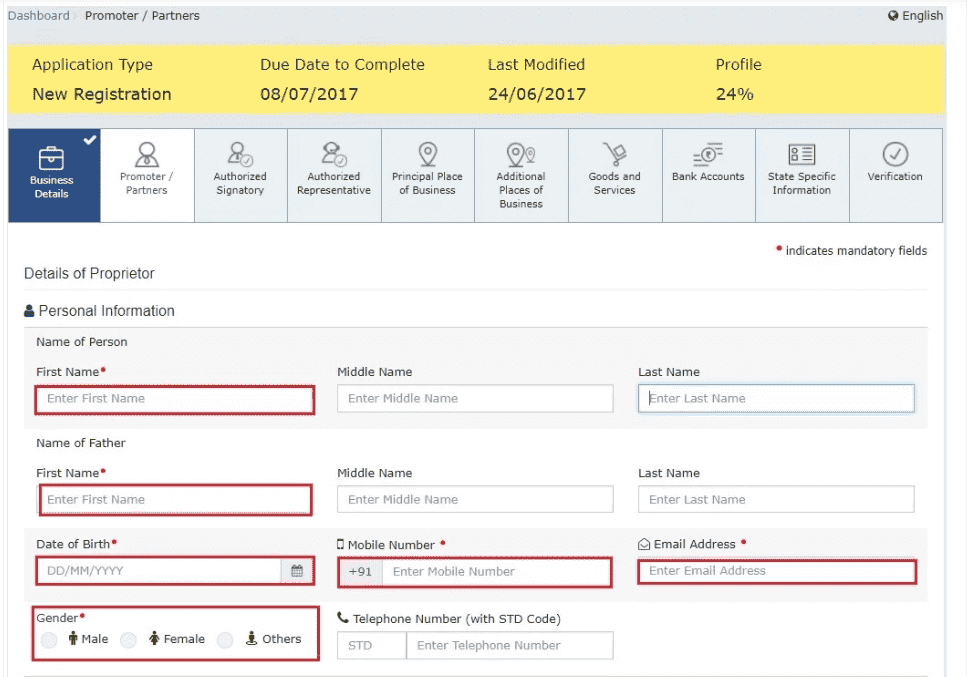

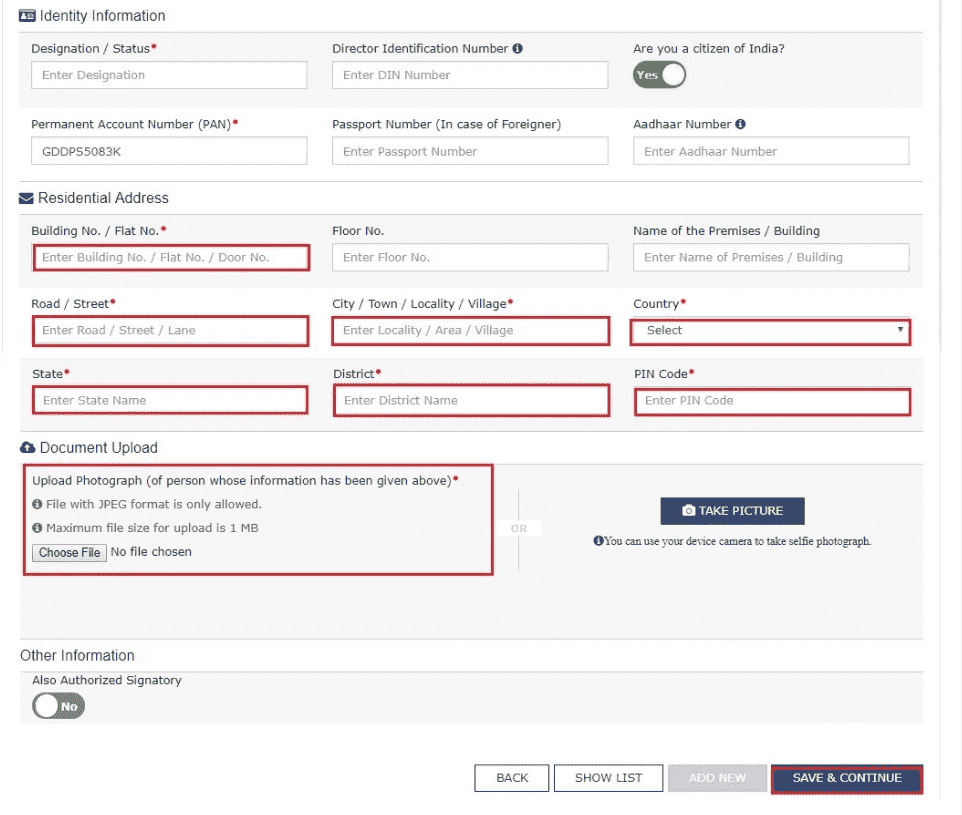

Step 5. Promoter ya Partner ke information ka submission

Iss window mein aap apne Business ke promoters ki saari details dalenge jaise ki naam, address, Date Of Birth, Mobile number, Email ID etc.

Step 6. Authorised Signatory ki Information

Authorised signatory ek aise individual hai jisko company ke promoters appoint karte hain aur woh company ki saari GST filings ke liye responsible hote hai. Company ke Promoter bhi uske authorised signatory ho sakte hai.

Agar ek promoter ko authorised signatory banane ke liye select liya jaata hai toh pichle section ka sara information iss section mein auto-fill hojaayega.

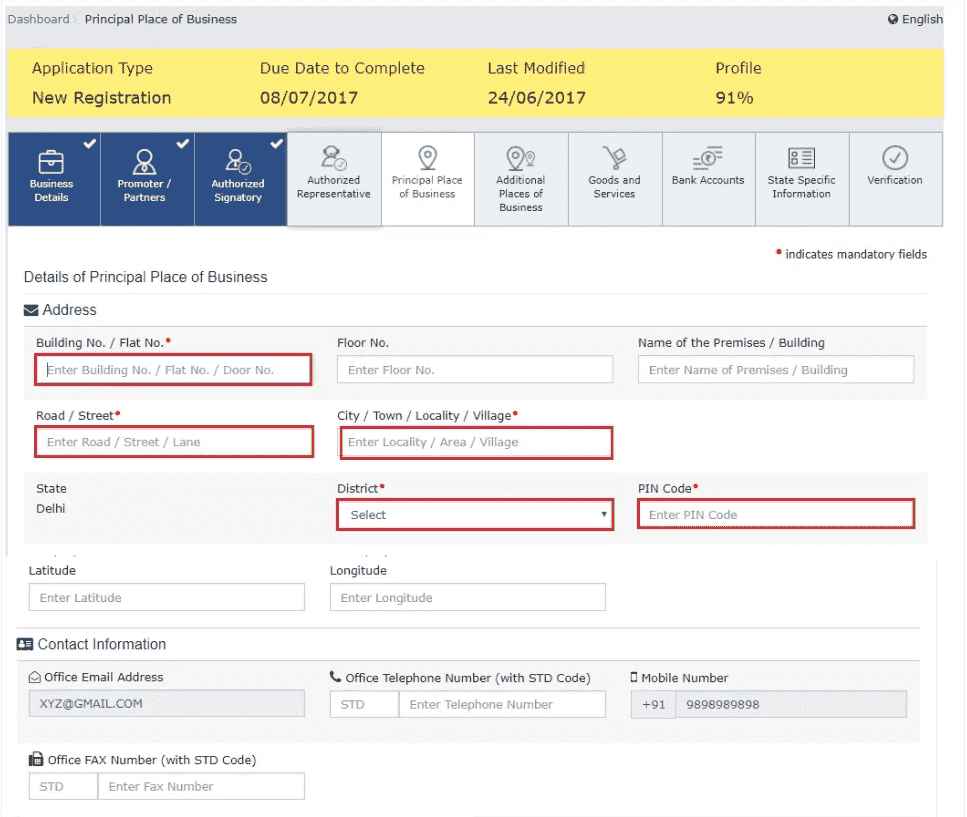

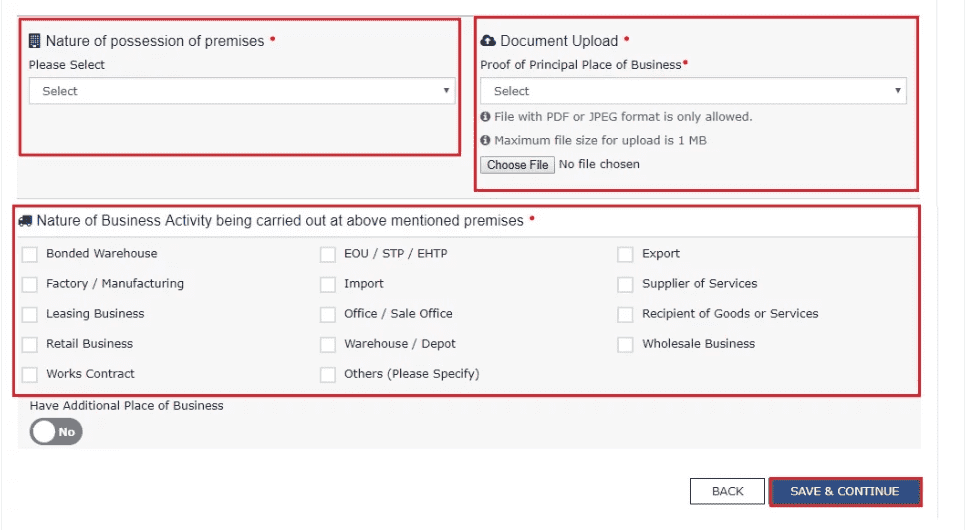

Step 7. Place of Business

Baaki saari information ke baad aapko apne business ka address daalna hoga.

Iske saath hi iss section mein aapko apne address proof ke liye documents submit karne padenge jaise ki Rent Agreement, Electricity Bill etc.

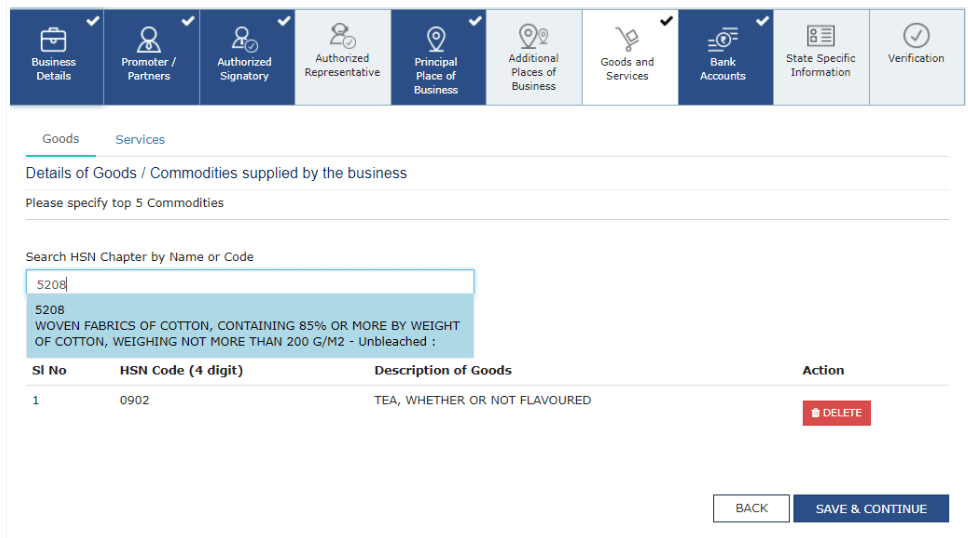

Step 8. Details regarding Additional Places of Business and Goods & Services

Iske baad aapko apne business ke aur bhi kuch details dene padenge jaise ki additional place of business( koi anya office aapke main office ke alawa) aur aapke industry aur goods and services ki details bhi.

Step 9. Bank Details

Iss section mein aapko bank details bharne honge jaise ki Bank Account no., IFSC Code etc aur inke documents proof bhi upload karne honge.

Step 10. Verification of Application

Verification complete hone ke baad verification checkbox ko select kijiye.Finally, application ko digitally sign kijiye Digital Signature Certificate (DSC)/ E-Signature ya EVC use karke.

Step 11: ARN Generated

Application sign karne ke baad ek success message display hota hai. Aapko iska acknowledgement agle 15 minutes mein apne registered e-mail address aur mobile phone number pe mil jaayega. Application Reference Number (ARN) receipt aapke e-mail address aur mobile phone number pe send kiya jaayega. GST ARN Number ko use karke aap apne GST registration application ke status ko track kar sakenge.

Humein umeed hai ki yeh article padhne ke baad humne GST Registration Kaise Kare ke baare mein aapke saare sawalon ke jawab de diye hain. Kisi bhi anya jankari ke liye humaare blog pe comment kare.

akarshit aap ye bhi process btao ki bank me apne company ke naam se account kaise khulwaaye…

Jaise zomato ki naam se bank account hai etc….

Ji thanks achha sujhav dene ke liye, hum jarur iss par bhi jaankari denge.